Florida Governor Ron DeSantis has recently signed a large tax bill that aims to provide tax relief and breaks to the people of Florida. This bill is being hailed as a significant step in helping businesses and residents in the state who have been reeling under the financial impact of the ongoing pandemic. The legislation is designed to benefit a wide range of people including families, small business owners, and residents. In this blog post, we’ll dive deep into the details of this enormous tax bill and how it impacts Floridians.

Florida Governor DeSantis Signs Enormous Tax Bill to Provide Tax Breaks to Floridians

Introduction

Florida Governor Ron DeSantis signed a tax bill that provides tax breaks to Floridians. The bill will enable Floridians to keep their tax dollars, regardless of their state of residence. This bill is the first of its kind in the United States, and it aims to help Floridians cope with the financial burden caused by the COVID-19 pandemic. The tax break will be given for summer activities, boating and water supplies, camping supplies, fishing supplies, pool supplies, children’s athletic supplies, and disaster preparedness supplies. This article will discuss the details of the tax breaks bill and how it can benefit the residents of Florida.

Benefits of the Tax Breaks Bill

Summer Activities

The tax break for summer activities includes admission tickets to water parks, sports venues, amusement parks, museums, and cultural events. The tax break also applies to fees for music lessons, dance classes, and art classes.

Boating and Water Supplies

The tax break for boating and water supplies includes boats, boat motors, boat trailers, fishing poles and gear, life jackets, water skis, and diving equipment.

Camping Supplies

The tax break for camping supplies includes tents, sleeping bags, camping stoves, propane gas containers, lanterns, and outdoor furniture.

Fishing Supplies

The tax break for fishing supplies includes fishing rods, reels, bait, tackle boxes, and fishing nets.

Pool Supplies

The tax break for pool supplies includes swimming pool pumps, heaters, filters, automatic pool cleaners, pool covers, and pool chemicals.

Children’s Athletic Supplies

The tax break for children’s athletic supplies includes running shoes, sports uniforms, sports equipment, gym bags, dance apparel, and sports and fitness classes.

Disaster Preparedness Supplies

The tax break for disaster preparedness supplies includes first aid kits, flashlights, batteries, plastic sheeting, duct tape, fire extinguishers, smoke detectors, radio receivers, and carbon monoxide detectors. The tax break also applies to baby supplies, such as diapers and formula, and pet supplies, such as food and water.

How to Utilize the Tax Breaks Bill

Floridians can use the tax breaks bill to save money when purchasing summer activities, boating and water supplies, camping supplies, fishing supplies, pool supplies, and children’s athletic supplies. They can also use the bill to prepare for disasters and emergencies by purchasing the necessary supplies tax-free.

The Florida Department of Revenue website provides detailed information about the tax breaks bill, including eligible items and qualifying purchases. Floridians can visit the website to find out more about the bill and how to take advantage of it.

The Call to Action

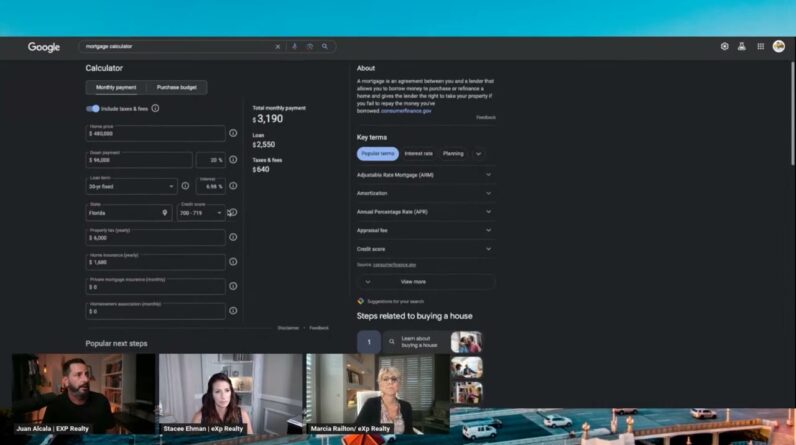

Juan Alcala is a Tampa-based realtor who is offering assistance to those who want to relocate to Tampa, St. Petersburg, or Clearwater. His video advertisement highlights the tax breaks bill as a reason to move to Florida. The video also provides links to resources about Tampa, Florida, such as the Wikipedia page, tourism website, city government website, TripAdvisor page, and Visit Florida website.

The video includes contact details for Juan Alcala, such as his phone number, email, website link, and appointment scheduling link. He invites people to subscribe to his YouTube channel, where they can find more information about living in Florida and relocating to Tampa.

Conclusion

The tax breaks bill signed by Governor Ron DeSantis provides Floridians with an opportunity to save money on summer activities, boating and water supplies, camping supplies, fishing supplies, pool supplies, and children’s athletic supplies. The tax breaks bill also encourages Floridians to be prepared for disasters and emergencies by providing tax breaks on first aid kits, flashlights, batteries, baby supplies, and pet supplies.

FAQs

- Who is eligible for the tax breaks bill?

- The tax breaks bill applies to Floridians who are purchasing eligible items and making qualifying purchases.

- How do I find out what I can purchase tax-free?

- You can visit the Florida Department of Revenue website to find a list of eligible items and qualifying purchases.

- How long will the tax breaks bill be in effect?

- The tax breaks bill will be in effect until December 31, 2021.

- How much money can I save with the tax breaks bill?

- The amount of money saved will depend on the eligible items and qualifying purchases.

- Can I use the tax breaks bill to purchase disaster supplies for my business?

- Yes, the tax breaks bill applies to both individuals and businesses for eligible items and qualifying purchases.