Welcome to our comprehensive guide on the cost of buying a home in Florida! Whether you’re a first-time buyer or a seasoned investor, this article is packed with everything you need to know about the expenses involved in purchasing a property in the Sunshine State. From down payments and closing costs to property taxes and insurance, we’ll walk you through each aspect, providing valuable insights and tips to help you navigate the Florida real estate market. So, let’s dive in and discover all the essential information that will empower you to make informed decisions as you embark on your homeownership journey in Florida!

The Cost of Buying a Home in Florida: Everything You Need to Know!

Introduction

Florida, also known as the Sunshine State, is a popular destination for individuals and families looking to purchase a home. With its beautiful beaches, vibrant cities, and favorable climate, it’s no wonder that people are flocking to this southern state. However, before you dive into the Florida real estate market, it’s important to have a comprehensive understanding of the cost of buying a home in the state. In this article, we will explore the various factors that contribute to the price range of homes in Florida’s popular metros, along with tips to help you make an informed decision.

Factors Influencing Home Prices

Metros with Larger Populations

Florida is home to several bustling metros, and it’s no surprise that these areas tend to have higher real estate values. Cities such as Miami, Orlando, and Tampa attract a significant number of people due to their economic opportunities, attractions, and amenities. The demand for housing in these areas drives up the cost of homes, making them more expensive compared to smaller, less populated regions.

Location and Amenities

The specific location of a home within Florida can also greatly impact its price. Properties situated in desirable neighborhoods, close to the beach, or with easy access to amenities like schools, shopping centers, and medical facilities tend to command higher prices. On the other hand, homes located in more remote or less desirable areas may be more affordable.

Size and Condition of the Home

Naturally, the size and condition of the home itself play a significant role in determining its cost. Larger homes with more square footage typically come with a higher price tag. Similarly, properties that have been recently renovated or are in pristine condition will be priced higher than those that require extensive repairs or updates.

Economic Conditions and Market Trends

Economic conditions and market trends can also impact home prices in Florida. During times of economic growth, when job opportunities are plentiful and incomes are rising, home prices tend to go up as well. Conversely, during economic downturns or periods of market instability, home prices may stabilize or even decline. Keeping an eye on these external factors can give buyers a better understanding of the current real estate market in Florida.

Median Home Prices in Florida Metros

To give you a better idea of the cost of buying a home in Florida, let’s take a closer look at some popular metros in the state and their corresponding median home prices:

- Miami: Known for its vibrant nightlife, diverse culture, and beautiful beaches, Miami has a median home price of around $400,000.

- Orlando: The home of Walt Disney World and other world-class attractions, Orlando has a median home price of approximately $320,000.

- Tampa: Situated on the Gulf Coast, Tampa offers a thriving job market and a variety of outdoor activities. The median home price in Tampa is around $275,000.

- Jacksonville: As Florida’s largest city by population, Jacksonville boasts a median home price of about $250,000.

- Destin-Fort Walton-Crestview: This area is renowned for its stunning beaches and outdoor recreational opportunities. The median home price here is approximately $350,000.

Keep in mind that these figures represent median home prices, which means there are homes available at a wide range of prices within each metro. The price range of homes varies significantly, but converges as you go down the list.

Tips for Making an Informed Decision

- Determine your budget: Before you begin your home search, it’s essential to know how much you can afford. Consider your income, expenses, and financial goals to establish a realistic budget.

- Research neighborhoods: Explore different neighborhoods within your desired metro area. Look for information on amenities, safety, school districts, and proximity to your workplace or other points of interest.

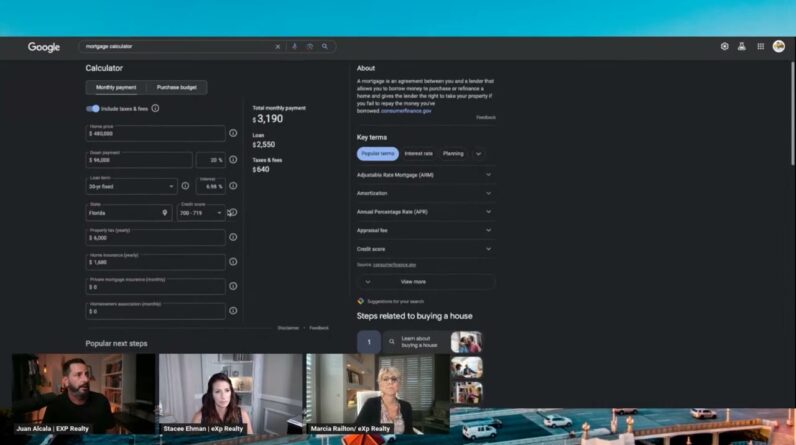

- Get pre-approved for a mortgage: Getting pre-approved for a mortgage will give you a better idea of what you can afford and streamline the buying process.

- Work with a real estate agent: A knowledgeable real estate agent can guide you through the home-buying journey, provide local market insights, and help negotiate a fair price.

- Attend open houses: Visiting open houses will give you the opportunity to view potential homes in person, ask questions, and evaluate if they meet your needs and preferences.

Conclusion

Buying a home in Florida can be an exciting and rewarding experience. However, it’s crucial to be well-informed about the cost of purchasing a home in the state. By considering factors such as location, home size, economic conditions, and market trends, you can make a more educated decision. Remember to establish a budget, research neighborhoods, and work with a trusted real estate professional to ensure a smooth and successful home-buying journey.

FAQs (Frequently Asked Questions)

-

Q: Is Florida a good state to buy a home?

A: Florida offers a favorable climate, beautiful beaches, and a variety of attractions, making it an attractive destination for homebuyers. -

Q: Are home prices in Florida affordable?

A: The affordability of homes in Florida depends on various factors, including location, size, and condition. There are options available in different price ranges to suit different budgets. -

Q: Are real estate prices in Florida stable?

A: Real estate prices in Florida can fluctuate based on economic conditions and market trends. It’s essential to stay updated on the current market situation. -

Q: Should I work with a real estate agent when buying a home in Florida?

A: Working with a real estate agent who has local knowledge and experience can be invaluable in navigating the Florida real estate market and ensuring a successful transaction. -

Q: How can I determine if a neighborhood is right for me?

A: Researching neighborhoods, visiting open houses, and considering factors like amenities, safety, and proximity to your needs can help you determine if a neighborhood is a good fit for you.

Note: This article is for informational purposes only and should not be considered as professional financial or real estate advice. It’s always recommended to consult with qualified professionals before making any significant financial decisions.